UTR number is a unique transaction reference number generated with every transaction you do in India. The name of this may vary with different transaction methods. In this article, we are going to know everything about the UTR number.

What is a UTR number?

UTR number is a unique transaction number that the banks generate with every transaction you make through any channel. Every transaction has a UTR number that makes it different from every transaction you make.

Other details might be the same in any two transactions, but the UTR number will always be different. The reference number also helps the bank and the government to monitor any money transaction other than the person sending it and the person on the receiving end.

Why do we need a UTR number?

As the UTR number is unique for every transaction you make, it helps the consumer to track their transition status. However, with the help of this Unique Transaction Reference number, one can check on all the details regarding the delays on a transaction.

[adinserter block=”7″]

For example, if someone sends you money in your bank account but you did not receive any money on your end. Then you can ask your sender for the UTR number. The UTR will generate at the end of the person who is sending the money.

If you provide the UTR number to your bank, the bank can easily track down your transaction details. The cause of delay, the weather there is a problem from the sender end, if there is any link failure or if it is bank’s internal problem due to which there is a delay on your transaction, they can find everything out very easily.

Is the UTR number generated on the online or offline mode of the transaction?

To put it in simple words, every time there is a transaction, there will be a UTR number, irrespective of whether you are using any mobile application or offline money transaction methods like NEFT or RTGS. All online money transferring applications like Google Pay, PhonePe, Amazon Pay, or Paytm generate a URT number on every transaction. People may often get confused as these applications may not mention the unique generated number as UTR number but as Transaction ID, Order ID, Transaction Reference, UPI Reference ID, Etc. All of the mentioned above tags represent unique transaction reference (UTR) number only.

[adinserter block=”1″]

Should you share the UTR number with anyone?

Yes, of course, you can share the UTR number with anyone attached to the transaction. But not to mention nobody expect you to put it out on your social media. The UTR number helps to track the funds and the transaction details. It does not reveal any of your details or bank details.

Example of a UTR number

UTR is a 16 or 22digits number. The former is for NEFT and the latter s for RTGS. It is unique for every transaction made in India. The reference number looks like “XXXXRCYYYYMMDD########” for RTGS and “XXXXSYYMDD######” for NEFT. The numbers are easily decodable.

- The first four digits stand for the bank you are transferring the money. For example, if you are transferring funds from SBI, then the first four digits will be SBIN.

- R stands for RTGS if the transaction mode is RTGS and C stands for the channel of the transaction.

[adinserter block=”6″]

In NEFT system S stands for the server type, N or H.

- For RTGS YYYYMMDD, stands for the year, month, and date. Such as for 2nd January 1998 we would see it written as “19980102.”

For NEFT YY represents the last two digits of the current year. The next three-digit MDD represents the date in the Julian system. So here it is 033 for 2nd January 1998.

(Julian date system is a date format that represents a particular day as the number of days since the beginning of the year. Such as 001 represents January 1st, 365 represents December 31st.)

- The last six or eight number represents the unique sequence number.

To format of UTR number can vary for different transaction modes. Even with several online applications, the unique transaction reference number may vary.

What is the UTR number for UPI?

UPI is a unified payments interface, which is the most popular interface to transfer funds nowadays. It is a real-time money transferring system that does transactions almost within a minute. Money transfer has never been this easy. The national payments corporation developed the scheme.

[adinserter block=”3″]

For a specific bank account, the UPI number remains the same. You may use several different applications but the UPI for those applications will be the same. This makes the UPI transaction user friendly that also unifies all the transaction through a single channel that is UPI. The applications like Amazon pay, BHM, Google Pay, Phonepe use this Unified payment interface to transfer funds between two banks or accounts.

Ever here, all the applications generate a UTR number to make your transaction traceable. In different applications, the UTR number may be under different tags like UPI transaction ID, reference ID, or UTR itself.

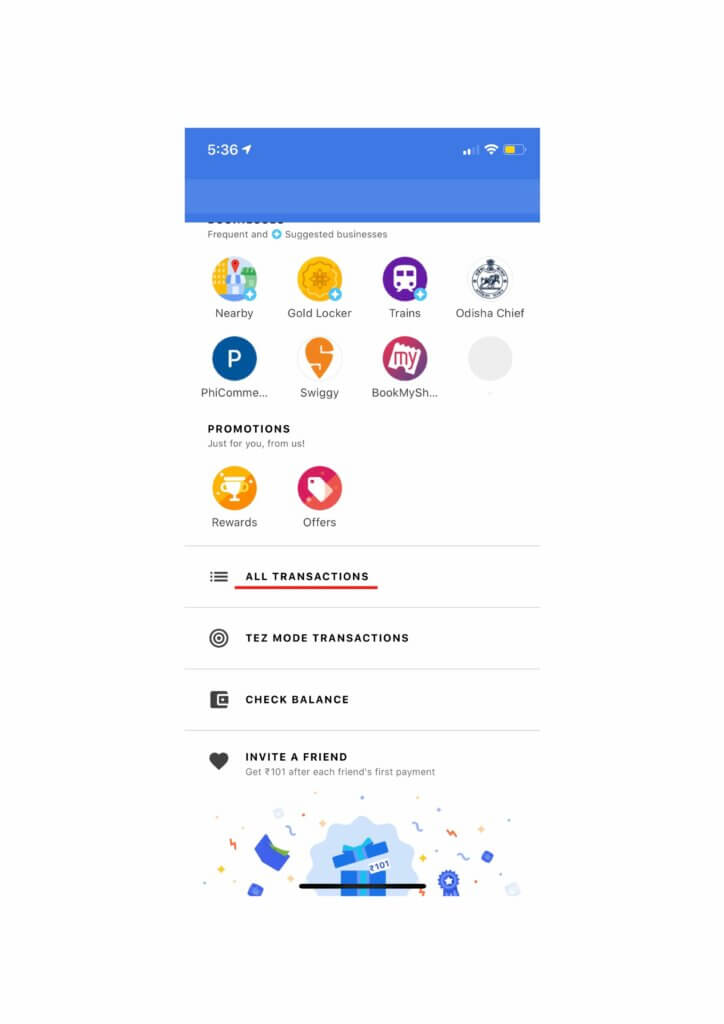

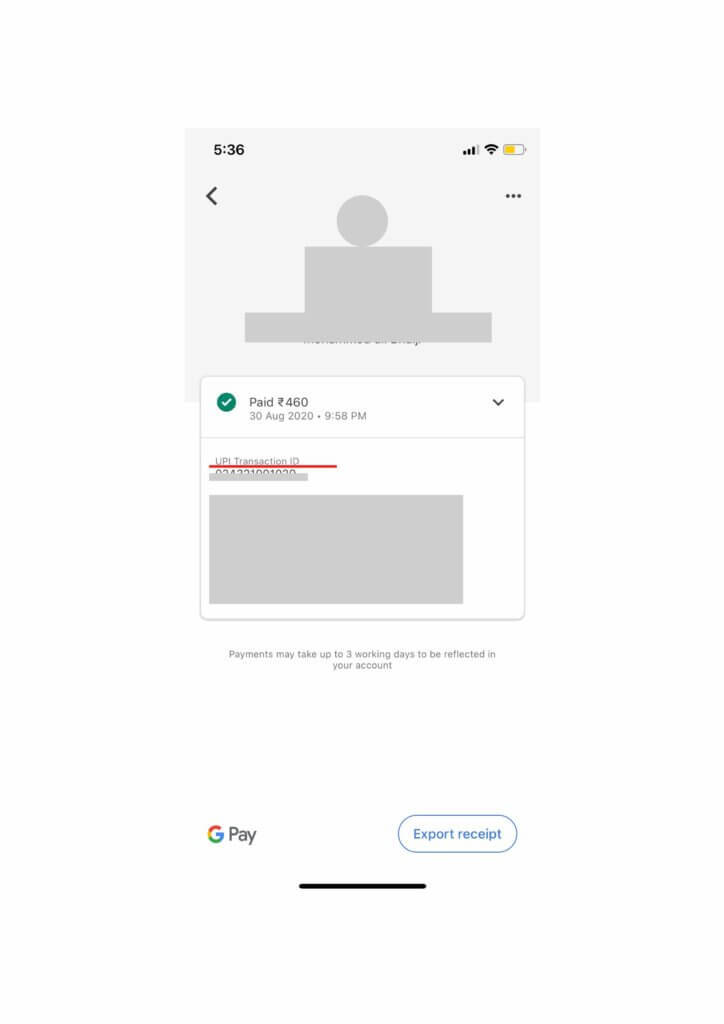

What is the UTR number in Google pay?

Google pay is one of the most popular money transfer platforms. Finding the UTR number in your Google Pay application might be a little bit tricky. Finding the UTR number is very important if your transaction got stuck or delayed. Or you want to check the status of your transaction. So here is a step by step guide to finding the unique transaction reference number on Google Pay.

- Scroll down to the Google Pay application and open it.

- Scroll down to the bottom and click on ‘all transactions’ on the home screen

- All the recent transactions you can find out here. Then select the transaction that you want to get the UTR number.

[adinserter block=”8″]

- There you can see a 12 digit unique number under the tag UPI transaction ID. It is your UTR number.

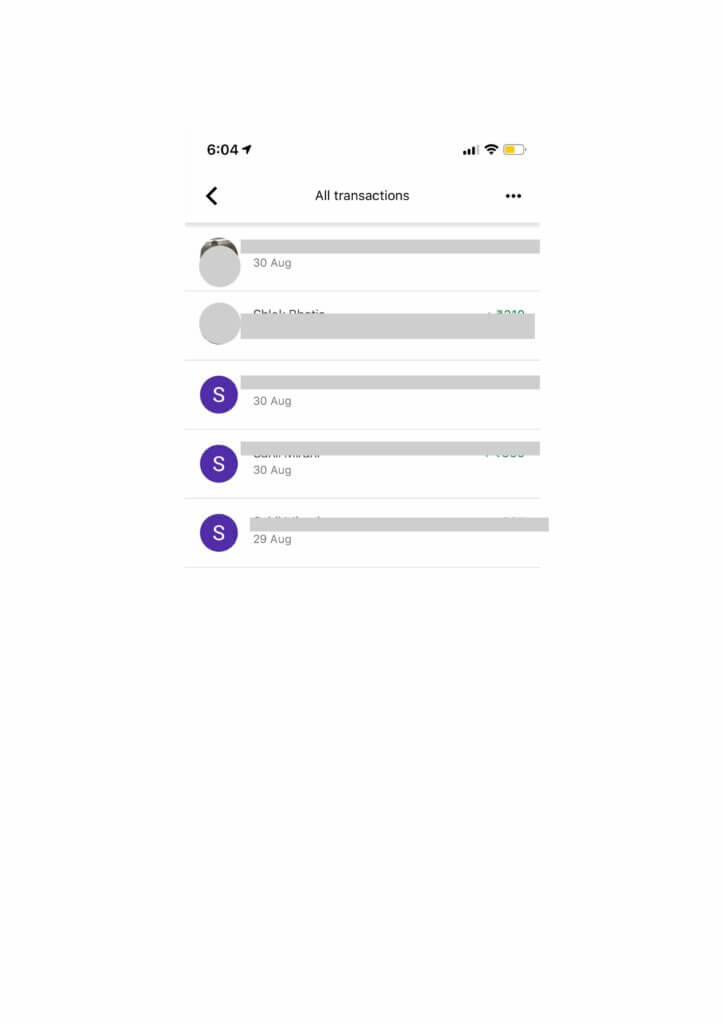

What s the UTR number in PhonePe?

[adinserter block=”4″]

PhonePe is another online money transferring app and very popular among peers. To find the UTR number against a transaction in PhonePe, you need to follow some simple steps mentioned below:

- Go to the PhonePe app on your phone.

- Go to history. Here you can see all the recent transactions from your account.

- Select the transaction that you want to find UTR.

- You can see the transaction details by clicking. The UTR number is under the UTR tag, a12 digit unique reference number.

What is the UTR number for IMPS?

IMPS is another money transferring method. It stands for Immediate Payment Service. The reference code generated on the IMPS system is for future use to trace the transaction. The reference number is a 12 digit unique number that banks provide the consumer upon every transaction. If the bank did not give you the IMPS number, then the account holder can look for the IMPS number online. On your bank statement, choose the fund transaction that you are trying to check the IMPS number. Upon selecting the particular transaction, the IMPS number or reference number will be there, displayed under the narration column.

How do I find out my UTR number?

To find out the Unique Transaction Number (UTR), you need to check your bank statement online. Select the specific transaction that you want to find the UTR number for, and then you can see the UTR number under specific tags as mentioned above. For online transactions, you can find the UTR number on those applications on the transaction history page. Select the particular transaction, and then you can see all the details of that specific transaction. The date, time, place, machine name, everything you can find out click on a particular transaction. Under the sane tag, you can find out the Unique Transaction Number too.

What is the UTR number in banks?

UTR number for banks is nothing but the unique reference number generated against each fund transfer. This unique number is different every time for each transaction. For two transactions, the other details could be the same, but the UTR number will always be different. It is how you can track every transaction, and you can also check the status of each fund transfer.

What is a UTR number example?

UTR number is a 16 digit number generally, but it can vary for different formats. For online transactions, the UTR number is 12 digits. An example of UTR number is: XXXXYYDDD######. The first four number stands for the bank code you are sending money. YY stands for the last two digits of the current year. For 2020 the digits will be 20. The next three digits are the Julian date of the year. For January, 31st the digits will be 031.

What is the SBI UTR number?

SBI UTR number is like any other UTR number. But for different banks, the first four digits will be different, according to the bank code. For SBI, the code is SBIN.

Can I check my UTR number online?

Yes, you can check your UTR number online from the bank’s website and also from your bank statement.

Is a UTR the same as a tax reference?

No, UTR is not the same as the unique taxpayer reference number. UTR in India means a unique transaction reference number that generates with every fund transaction done in India. But the unique taxpayer number is a 10 digit number for every taxpayer in the UK. It is a unique reference number, but this remains the same for every citizen of the UK lifelong. But UTR is unique and different for every transaction.